Why Mortgage Rates Could Continue To Decline

When you read about the housing market, you’ll probably come across some information about inflation or recent decisions made by the Federal Reserve (the Fed). But how do those two things impact you and your homebuying plans? Here's what you need to know.The Federal Funds Rate Hikes Have StalledOne

Read More

Buying a home during the holiday season is a hack

The holiday season is traditionally perceived as a time for festivities, family gatherings, and lavish celebrations. However, this time of year can also be a hidden gem for buyers in the real estate market. While many people put their real estate plans on hold during the holidays, those who choose t

Read More

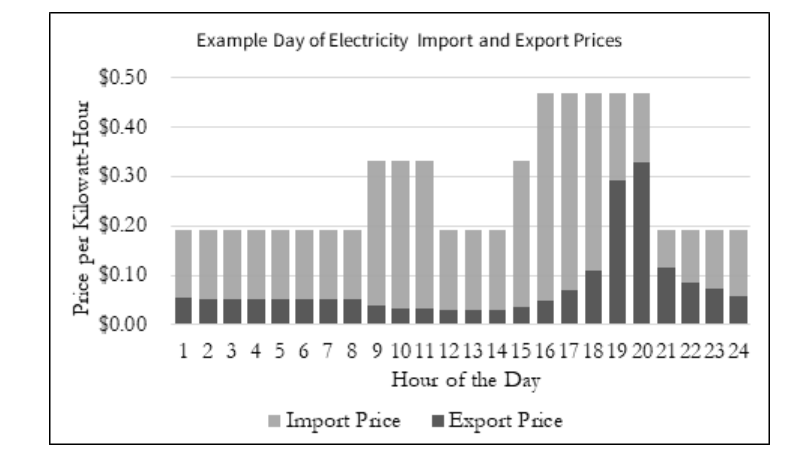

What is NEM 3.0 and How Will it Impact California Solar Owners?

NEM 3.0 Final Decision: The California Public Utilites Commission (CPUC) unanimously voted to approve NEM 3.0. Under NEM 3.0, customers of PG&E, SCE, and SDG&E with solar systems will receive an average of 8 cents per kWh for the excess power they push onto the grid. This is roughly 75% less than th

Read More

Categories

Recent Posts